Payday loans have become a common financial tool for individuals in need of quick, short-term cash. These loans are designed to help borrowers cover unexpected expenses between paychecks, making them an attractive option for many. However, payday loans can come with high-interest rates and fees, which may lead to financial strain if not managed properly. One platform that offers payday loans is eLoanWarehouse, a trusted provider in the payday loan industry. In this article, we will explore what payday loans are, how eLoanWarehouse operates, the pros and cons of using payday loans, and how to make the most of these financial tools while avoiding potential pitfalls.

What Are Payday Loans?

Payday loans are small, short-term loans that are typically due on your next payday. They are often used by individuals who need quick access to cash but may not have access to traditional credit sources. Payday lenders typically do not require a credit check, making these loans accessible to those with poor or no credit history. The loan amount is usually based on the borrower’s income, with repayment expected in full on the borrower’s next payday. While payday loans can be a quick solution in a financial emergency, they come with high interest rates and fees, which can quickly accumulate if not repaid on time.

The Role of eLoanWarehouse in Payday Loans

eLoanWarehouse is an online platform that connects borrowers with payday lenders. It serves as a loan marketplace, helping individuals find payday loan options that suit their financial needs. Borrowers can apply for a payday loan through the platform, and eLoanWarehouse matches them with lenders who are willing to offer a loan based on their eligibility. By offering a variety of lenders, eLoanWarehouse helps borrowers compare terms and find the best payday loan options available to them. The process is fast, convenient, and can often be completed entirely online, making it a popular choice for those in urgent need of cash.

How eLoanWarehouse Works

Using eLoanWarehouse is relatively simple. The first step is to fill out an online application, providing personal information such as income, employment status, and banking details. Once the application is submitted, eLoanWarehouse uses its network of payday lenders to match the borrower with a suitable lender. If approved, the lender will deposit the loan amount directly into the borrower’s bank account, typically within a few hours or by the next business day. The borrower is then responsible for repaying the loan on or before the due date, which is usually aligned with their payday.

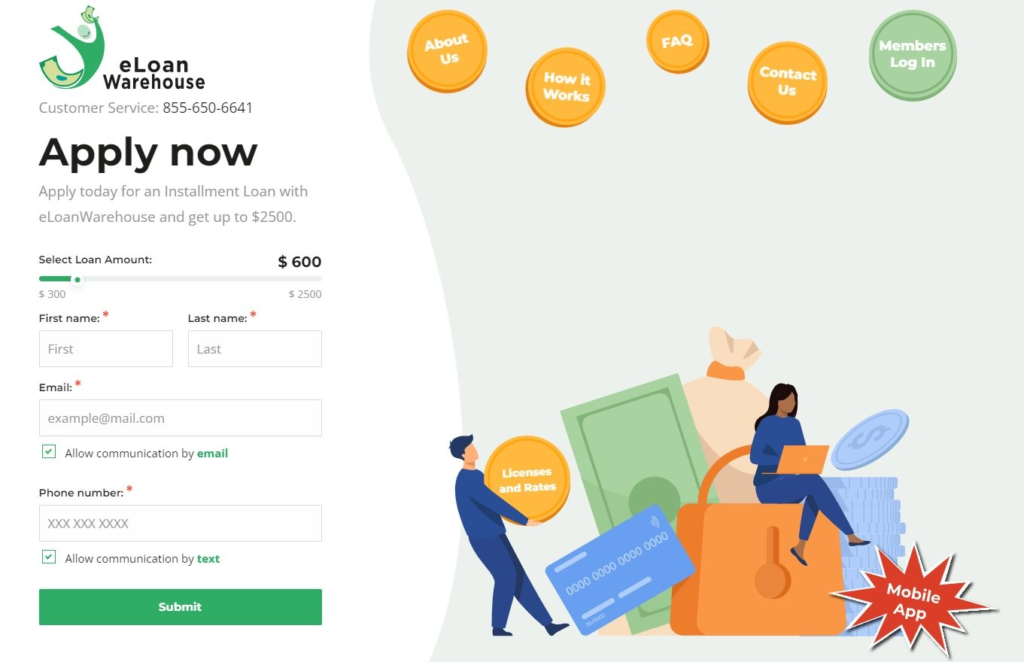

How to Apply for a Loan Through EloanWarehouse

Applying for a loan with Payday Loans EloanWarehouse is straightforward. Here’s the step-by-step process:

- Visit the Website: Navigate to their official platform.

- Fill Out the Form: Provide basic personal and financial details.

- Submit Required Documents: Upload proof of income and identification.

- Approval and Disbursement: Once approved, funds are typically disbursed within the same day.

Key Features of Payday Loans EloanWarehouse

- Simple Application Process: Their user-friendly platform simplifies the loan application process.

- Quick Approvals: Most loans are approved within hours.

- Flexible Loan Terms: Borrowers can choose terms tailored to their needs.

- Transparent Policies: There are no hidden fees or unexpected charges.

Advantages of Using Payday Loans EloanWarehouse

Choosing Payday Loans EloanWarehouse comes with numerous benefits:

- Speed: Quick application and approval process ensure timely financial aid.

- Accessibility: Open to individuals with varying credit scores.

- Convenience: Entirely online with no physical paperwork.

- Reliability: A trusted name in the payday loan industry.

Who Can Benefit from Payday Loans EloanWarehouse?

This service is ideal for individuals facing sudden financial emergencies, such as unexpected medical expenses, car repairs, or utility bill payments. It’s especially helpful for those who may not qualify for traditional bank loans.

How Payday Loans EloanWarehouse Stands Out

In a competitive market, Payday Loans EloanWarehouse distinguishes itself by prioritizing customer experience. With clear communication, robust security measures, and an intuitive interface, it has become a go-to option for many.

Interest Rates and Fees

While payday loans are known for higher interest rates compared to traditional loans, Payday Loans EloanWarehouse ensures transparency in all its financial dealings. Borrowers are informed about rates and fees upfront, avoiding any surprises.

Tips for Repaying Payday Loans Successfully

- Budget Wisely: Allocate funds for repayment before spending your paycheck.

- Communicate: Inform the lender if you face repayment challenges.

- Avoid Rollovers: Pay on time to prevent additional fees.

Alternatives to Payday Loans EloanWarehouse

Although this service offers great benefits, borrowers might also consider alternatives like:

- Credit Union Loans: Often with lower interest rates.

- Installment Loans: For longer repayment terms.

- Personal Loans: A viable option for larger sums.

Is Payday Loans EloanWarehouse Safe?

Yes, Payday Loans EloanWarehouse prioritizes user security, employing advanced encryption to protect personal and financial data.

Common Misconceptions About Payday Loans

- High Interest Equals Exploitation: While rates are higher, the short-term nature balances the cost.

- Only for Poor Credit: Though helpful for those with bad credit, it’s accessible to all.

What to Consider Before Applying

- Loan Amount Needed: Only borrow what you can repay comfortably.

- Repayment Term: Understand the terms to avoid penalties.

- Hidden Fees: Confirm all details during the application process.

Customer Experiences with Payday Loans EloanWarehouse

Many customers report positive experiences, highlighting the platform’s speed, simplicity, and customer service.

Why Choose Payday Loans EloanWarehouse?

- Fast Cash: Ideal for urgent needs.

- Inclusive: Serves diverse financial backgrounds.

- Transparent: Honest about costs and conditions.

Benefits of Using eLoanWarehouse for Payday Loans

One of the main advantages of using eLoanWarehouse for payday loans is the speed and convenience it offers. Traditional payday loan applications often require in-person visits to a storefront, whereas eLoanWarehouse allows users to apply for loans from the comfort of their home. The online application process is quick, and in many cases, borrowers can receive funds on the same day they apply. Additionally, eLoanWarehouse offers a wide variety of lenders, giving borrowers the ability to compare loan terms, interest rates, and fees to find the best deal available.

Another benefit is the ease of use. For many individuals, navigating the payday loan market can be confusing, especially when considering the high number of lenders available. eLoanWarehouse simplifies this process by acting as an intermediary, helping borrowers find trusted lenders with competitive rates and favorable loan terms. This eliminates the need for borrowers to conduct extensive research on their own, saving both time and effort.

Steps to Maximize Loan Benefits

- Borrow Only When Necessary: Use loans for genuine emergencies.

- Repay Promptly: Avoid late fees or increased debt.

Risks and Drawbacks of Payday Loans

While payday loans can be a lifeline in times of financial need, they come with significant risks. The most notable risk is the high-interest rates and fees that are typically charged on payday loans. These can easily exceed 400% APR, making it incredibly expensive to borrow money. If the loan is not repaid on time, additional fees and interest can accrue, leading to a cycle of debt that can be difficult to break.

Another potential drawback is that payday loans are typically due in full on the borrower’s next payday, which can be difficult for some individuals to manage. If the borrower is unable to repay the loan on time, they may be forced to roll over the loan, leading to even more interest charges and fees. This cycle can quickly become overwhelming, making payday loans an unsustainable long-term financial solution for many individuals.

How to Avoid the Pitfalls of Payday Loans

To make the most of payday loans without falling into the trap of excessive debt, it’s important to approach them with caution. One key strategy is to only borrow what is absolutely necessary. While payday loans may be tempting, borrowing more than you can afford to repay can lead to financial problems down the road. It’s also important to be aware of the loan terms, including the interest rates and repayment deadlines. Make sure you fully understand the costs involved before accepting a payday loan.

Another helpful tip is to plan your repayment in advance. Make sure you have enough money to cover the loan repayment when it’s due, and avoid rolling over the loan if possible. If you’re concerned about repaying the loan on time, consider seeking alternative sources of funds, such as a personal loan from a bank or credit union, which may offer better terms and lower interest rates.

Alternatives to Payday Loans

While payday loans can provide quick cash in times of need, they should not be relied upon as a long-term financial solution. Several alternatives to payday loans may be more affordable and less risky. For example, many credit unions and community banks offer small, short-term loans with lower interest rates and more flexible repayment terms. Personal loans from friends or family members may also be an option, as these loans often come with no interest or fees.

Additionally, some employers offer paycheck advances to their employees, allowing them to access a portion of their salary before payday without the high costs associated with payday loans. It’s important to explore all available options before committing to a payday loan, as there may be more affordable solutions that better suit your financial situation.

Is eLoanWarehouse a Reliable Payday Loan Platform?

eLoanWarehouse has established itself as a reliable platform for connecting borrowers with payday lenders. However, as with any financial product, it’s important to exercise caution and ensure that the terms of the loan are clear before proceeding. eLoanWarehouse works with reputable lenders, but it’s still important to carefully review the loan agreement and ensure that you can comfortably repay the loan on time.

The platform provides transparency in terms of fees and interest rates, allowing borrowers to make informed decisions about their financial options. However, it’s always advisable to explore other alternatives and compare loan offers before committing to a payday loan.

Future of Payday Loans EloanWarehouse

The growing reliance on digital solutions ensures that Payday Loans EloanWarehouse will continue to evolve, offering even more customer-centric services.

Conclusion

Payday loans can be a helpful financial tool in times of need, but they should be used with caution. eLoanWarehouse offers a convenient platform for borrowers to access payday loans quickly, but it’s important to understand the potential risks involved. By borrowing only what you need, understanding the loan terms, and exploring alternative options, you can make the most of payday loans while avoiding the pitfalls that can lead to financial strain.

Frequently Asked Questions

What is eLoanWarehouse?

eLoanWarehouse is an online platform that connects borrowers with payday lenders, offering a convenient way to apply for short-term loans.

Are payday loans from eLoanWarehouse safe?

eLoanWarehouse works with reputable payday lenders, but it’s important to review loan terms carefully and ensure you can repay the loan on time.

How fast can I get a payday loan through eLoanWarehouse?

In many cases, borrowers can receive funds on the same day they apply, depending on the lender and the time of application.

Can I get a payday loan with bad credit?

Yes, payday loans are often available to individuals with poor or no credit history, as payday lenders typically do not conduct credit checks.

What are the risks of payday loans?

The main risks of payday loans include high-interest rates, fees, and the potential for a cycle of debt if the loan is not repaid on time.